Discover the Best Live Online Finance Classes

Although most people are familiar with finance, they may not know exactly what goes into understanding it. Everyone has a bank account they deposit money into and withdraw money from. Governments and large companies store money in large financial accounts. Finance encompasses the entire process of managing that money.

During learning about finance, you will need to consider many different areas. Personal finance refers to the finances you manage daily. Corporate finance refers to the finances used by businesses worldwide to run their daily operations. Last, public finance refers to how governments manage revenue, expenditures, and debts. There are different areas of finance within each of these three, including investing, budgeting, lending, saving, forecasting, borrowing, and studying money.

Learning finance benefits everyone, whether you want to improve your financial standing or enter the industry professionally. Financial jobs are available in every industry worldwide because every business needs money to function.

Best Live Online Finance Classes & Schools

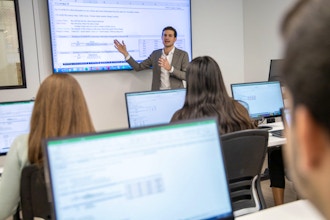

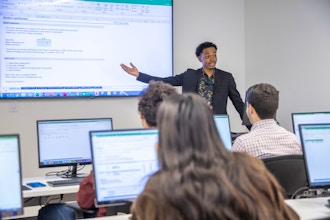

No matter what your skill is, training is an effective way to learn it. With a skill like finance, you will not have a problem finding a program that fits your creative and professional goals. Various options are available to you, no matter where you live. Live online training gives you access to more schools. You can choose courses that fit your learning needs.

Practical Programming offers a Python for Finance Immersive online course. This advanced-level course will teach students to manipulate financial data and use Python financial libraries. The course meets for three sessions, totaling 18 hours, with students creating VAR models and Monte Calo simulations using Python libraries. Prior experience with Python and financial concepts is required for this advanced-level course.

While based in New York, Noble Desktop offers several live online options for students outside New York. The Financial Analyst Training Program provides students with basic and intermediate functions in Excel. Students will learn Excel financial modeling, where they will begin working with several financial functions to make creating financial statements easier. In addition to reviewing corporate finance and accounting concepts, students will also learn how to build a three-statement financial model. Students can pursue a career in financial analysis at the end of the course.

Since 1923, the American Management Association has led talent development globally. It provides educational products and services to both individuals and organizations. Most classes at AMA are geared towards developing corporate skills, such as project management, management, and communication. Students can opt to take the two-session Fundamentals of Finance and Accounting course. This course teaches students how to grasp the numbers side of their job and translate performance into financial terms. They will learn different accounting processes and principles. Students will also know how to read and put together different financial statements.

NetCom Learning offers a Microsoft Dynamics 365 Finance course to students 16 years and older. Before enrolling in this course, students should understand accounting skills and Dynamics 365 Core. Students will learn various financial concepts throughout the course, including financial management, ledgers, configuring sales tax, credits, collections, fixed assets, budget planning and cost accounting. This course meets for four sessions; each session is six hours.

Industries That Use Finance

Knowledge of finance is an important skill for professionals in almost every industry since it is an integral part of our everyday life. The field of finance can lead to a variety of careers. Depending on your interests and the industry you want to enter, you can pick the school or class you want to take to fit more into that industry. If you are unsure where to apply your financial skills, here are some industries to consider.

- The manufacturing industry involves purchasing inventory and equipment, which can tie up a large amount of capital. You can either deal with the finance aspect, which deals with managing these high-cost assets or go into financing, which deals with the financial strategy to acquire assets.

- Combining IT and finance often results in new technology for the financial business. However, IT companies still have financial jobs that also deal with their financial data.

- The aerospace industry finance refers to the purchase or creation of aircraft.

- In business, finance is key in procuring goods, raw materials, and other economic activities. It is essential for running any business.

- The financial services industry includes banks that offer various services, including mortgages, credit cards, payment services, tax preparation, accounting, and investing.

Finance Jobs & Salaries

There are several financial jobs available to you, regardless of the industry. You will need different financial skills to be successful in each position, but you can tailor your training to meet those needs if you know which one you want to pursue. In line with US Bureau of Labor Statistics projections, financial jobs will grow by 7% between 2021 and 2031, the average for all occupations. The financial industry will create approximately 700,000 new jobs during this time, and about 1 million job openings will need to be filled each year. Below are some financial careers you may wish to pursue.

Accountants ensure that financial documents, including taxes, are accurate and clear. Aside from doing math, accountants must be able to communicate their conclusions to a wide audience, including writing reports or presenting their findings verbally. Additionally, accountants can advise individuals and groups. Their salaries in the United States range from $40,000 to $85,000.

A Financial Analyst analyzes financial data and recommends investments or businesses based on factors like business environments, market trends, company financial status, and expected results. In the United States, the average salary ranges from $50,000 to $105,000 per year.

A Financial Advisor assesses clients' financial situation and helps them achieve their goals. They assist clients with establishing financial plans for their goals and help them invest their clients' money, including college savings, estate planning, insurance, investments, mortgages, and taxes. In the United States, they make $40,000 to $155,000 a year.

In the US, bankers are responsible for opening accounts, providing loans and investments, and managing their clients' money. Their salary ranges from $35,000 to $65,000 per year.

Payroll Clerks in the US are responsible for keeping track of time logs and ensuring employees receive their paychecks on time. Their annual salary ranges between $35,000 and $65,000.

The average annual salary for economists is between $60,000 and $190,000. They study the relationship between a society's goods, services, and resources production.

The salary of a Risk Analyst ranges from $50,000 to $130,000 per year. Risk Analysts are responsible for analyzing plans and offering financial advice for companies looking to expand or invest in new markets.

Managing a company's financial actions is the responsibility of the Chief Financial Officer (CFO). They supervise lower-level financial managers, assess financial risks, and ensure that all financial reports are accurate. CFOs can make between $90,000 and $245,000 annually, depending on the company's size.